Norway | Current State of Crowdfunding 2021

The Current State of Crowdfunding in Norway

What is the current state of crowdfunding in Norway? This year, based on the Norwegian crowdfunding market performance in 2020, CrowdfundingHub has carried out the research on the analysis and the information regrouping of the crowdfunding market in Norway.

The Norwegian crowdfunding market has seen a 102% increase since 2019, reaching €89,2 million this year. €38,6 million of the collected amount was assembled during the fourth quarter, in which the market experienced a 108% increase from the previous one. Real estate crowdfunding dominated the market, taking up 70% of the total volume.

Donation-based and Reward-based Crowdfunding

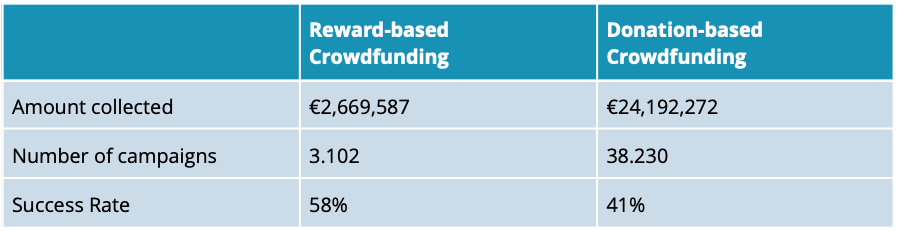

The donation-based and reward-based crowdfunding market represented 27% of the collected volume, reaching €26,8 million in 2020. This number showed a 142% increase from the €9,9 million collected in 2019. In 2020, €2,7 million was raised in reward-based crowdfunding, financing 3.102 projects with a success rate of 58%.

An overview on the donation-based and reward-based crowdfunding market

Active donation-based and reward-based platforms: Birda, CulturaFlokk, Spleis, Startskudd, Lokalverdi

Equity-based Crowdfunding

In Norway, 19,5% of the collected volume was raised by the equity-based crowdfunding market. In 2020, the equity-based crowdfunding market reached €17,4 million, financing 58 projects with a success rate of 89%.

Most of the funds of the equity-based market were gathered from the fourth quarter of 2020, during which €9 million was collected. Whereas in 2019, only €0,9 million was collected during the fourth quarter. The fourth quarter of 2020 therefore showed an 880% increase as compared to that of 2019.

Active equity-based platforms: DealFlow, Folkeinvest, Invesdor, Around.no, SparkUp

Lending-based and Real Estate Crowdfunding

The consumer lending-based crowdfunding market represented the lowest percentage of the collected volume: only 1% of the collected funds constituted this market segment. In 2020, the consumer lending-based crowdfunding financed 80 projects with a total collection of €860.000, with these projects having a 100% success rate.

On the other hand, property lending dominated the crowdfunding market in Norway, reaching €32,2 million during 2020. 118 projects were financed with a 100% success rate. The second biggest player of the market was business lending, in which 50 projects were financed, totaling €11,9 million.

During the past few years, Norway has observed a substantial increase in the property lending crowdfunding market. One possible explanation is that property investment is easier for investors to understand as compared to high-risk startup investments. Property lending is also believed to be less risky due to its concrete and specified investment rate as well as the scheduled repayment actions.

At the same time, the Norwegian real-estate market has been growing because of the increase in demand in all urban areas. It is important not to forget that in Norwegian culture, purchasing real estate properties is more valued than renting, since real-estate is seen as a more secured asset. This ideology boosts the Norwegian real estate market, including property lending.

Active lending-based platforms: Monner.no, FundingPartner, Kameo, PERX, Kredd, Trine

Download the report HERE for more detailed research result.