Research | Distributing European Funds Through Crowdfunding Platforms

We are proud to announce the publication of our research report Unlocking the crowdfunding potential for the European Structural and Investment Funds. This research was developed for the European Commission (DG Regio) to identify the potential of combining European investment funds (ESIF funds) with crowdfunding.

This report provides an in-depth overview of the current status of the Crowdfunding industry in Europe and the potential to use Crowdfunding platforms by public authorities to realize the ambitions of the Cohesion Policy and provide (match) funding to projects through crowdfunding platforms.

Together with crowdfunding experts Ana Odorovic and Karsten Wenzlaff and Cohesion Policy experts from PwC – Apolline Mertz, Brian Kessler, Karim Karaki and Lucas Novelle Araújo – we developed this state-of-the art report analyzing the legal, strategic and market challenges and creates practical blueprints for public/managing authorities to start working together with crowdfunding platforms.

ECSP regulation is an enabler for European Funding

The European crowdfunding regulation (ECSP) is paramount to the development of crowdfunding across the EU, by attempting to strike an optimal balance between providing a solid regulatory framework and limiting oversight to allow innovation, i.e. providing a predictability without overburdening.

The ECSP allows platforms to operate and be recognised across the EU based on a single set of rules, and platforms are required to undertake financial-return intermediation activities under supervision of the financial regulator in each Member State.

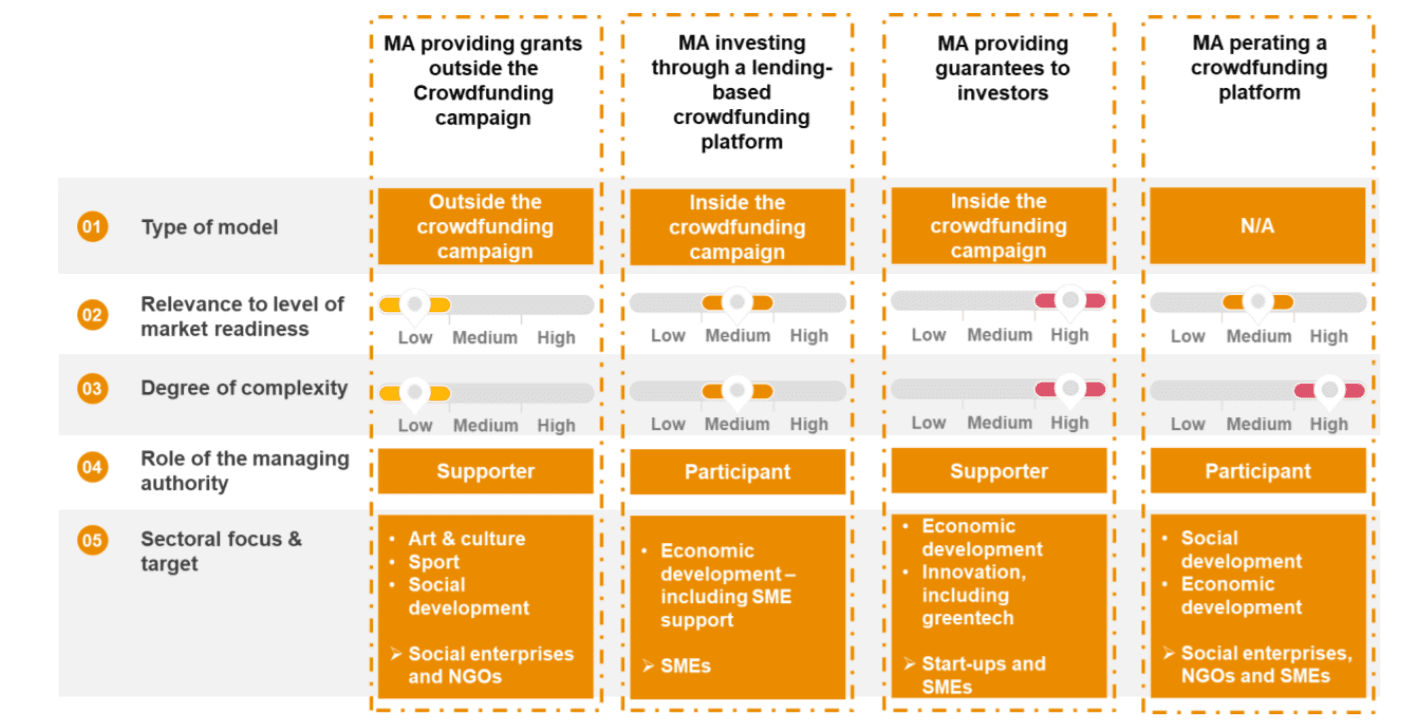

MAs can play different roles in the crowdfunding process, based on the type and nature of support provided (e.g. non-financial or financial; within or outside the crowdfunding process) and the recipient (e.g. investors or project owners). The roles involve varying integration levels of responsibilities between platform operators and MAs and thus varying degrees of legal complexity and applicability of CPR rules.

In light of the CPR, all types of crowdfunding platforms could be considered as intermediate bodies or financial intermediaries for the implementation of ESIF. However, the ECSP license does not grant crowdfunding service providers the right to provide individual or collective asset management services.

Under ECSP regulation, lending-based crowdfunding platforms could act as financial intermediaries for the implementation of ESIF, whereas investment-based platforms can do so only if they hold a MiFID investment firm or AIFM license under the national regime, as this would allow them to manage assets on behalf of the MA.

Cohesion Policy for inclusive growth in Europe

The Cohesion Policy is one of the key instruments of the European Union (with a budget of €373 billion between 2021-2027) to promote harmonious development and to reduce disparities among regions, thus strengthening economic and social cohesion.

Acting towards this ambitious goal requires innovative policy mechanisms that crowd in private investments to address the diverse market needs and mitigate market failures, while at the same time improving the efficiency and usefulness of public spending.

In this context, crowdfunding has emerged as a new source of finance. Innovators, social entrepreneurs, nonprofit organizations, SMEs or any citizen can use crowdfunding to attract resources from investors to finance their business ideas through digital platforms, thus contributing to the democratization of access to finance.

Opportunity for Public Authorities / Managing Authorities

The development of crowdfunding presents an opportunity for ESIF Managing Authorities (MAs) to leverage on these platforms to channel resources towards segments of the market that are currently not covered by traditional financing players, but that are pivotal for the economic and social development of the European Union.

This report explores synergies between the Cohesion Policy and crowdfunding by assessing the strategic, operational and legal considerations of combining ESIF with crowdfunding, and presenting several case-studies and blueprints that could be used by MAs as a first step when investing in crowdfunding.

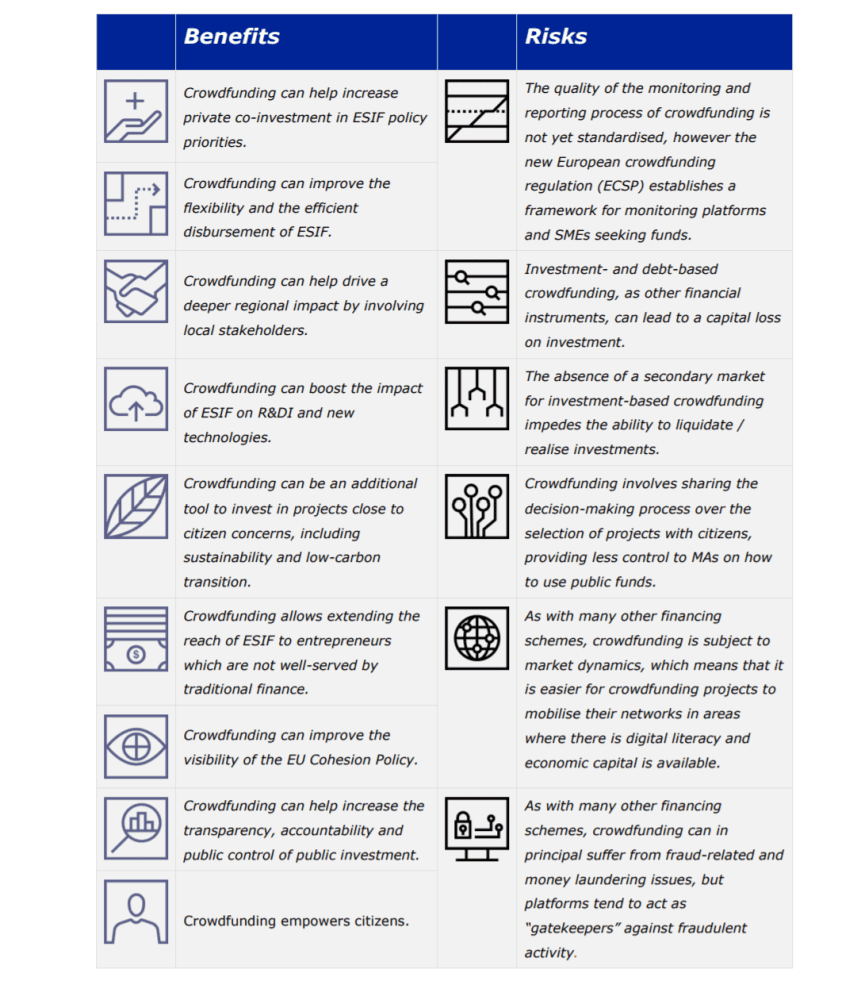

ESIF Benefits and Risks – CrowdfundingHub

Six case studies

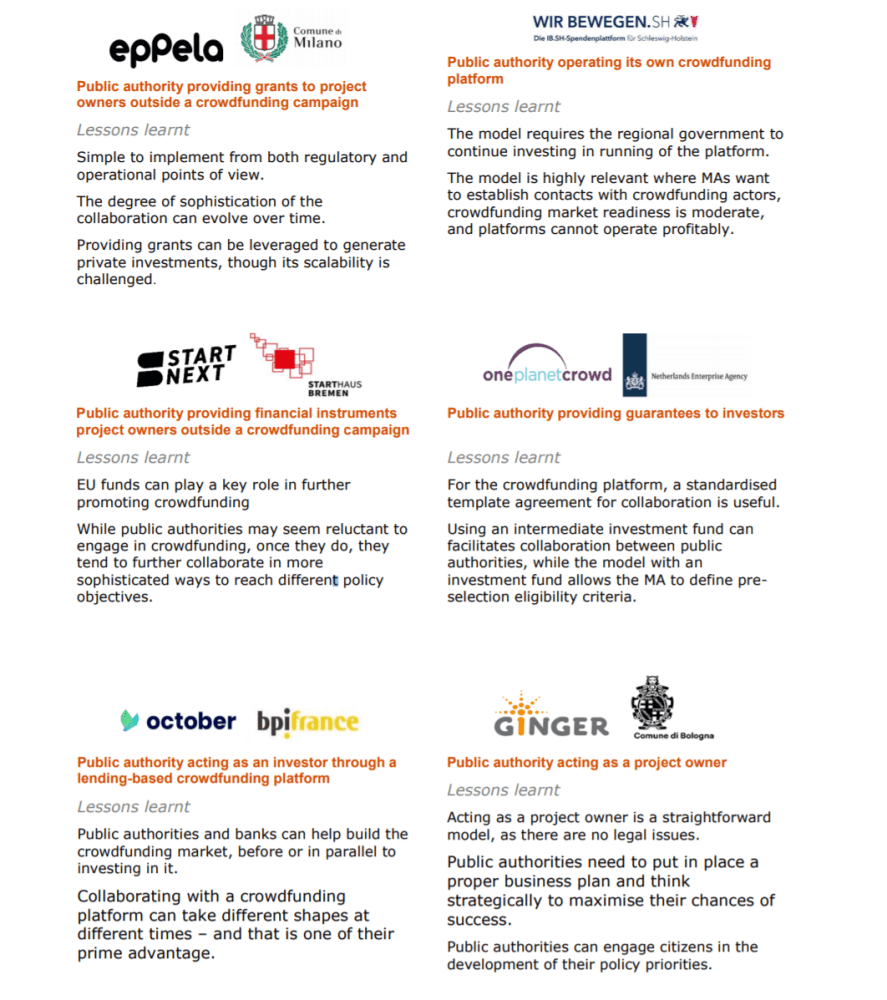

Within the research 6 different case-studies of collaboration between public authorities and crowdfunding platform were analysed:

6 Case studies ESIF Report – CrowdfundingHub

Blueprints

Based on the research and case studies we developed 4 different blueprints for public authorities to start experimenting with working together with crowdfunding platforms:

- Providing grants outside a crowdfunding campaign

- Investing through a lending-based crowdfunding platform

- Providing guarantees to investors

- Operating a crowdfunding platform

For more information, download the full report here: Unlocking the crowdfunding potential for the European Structural and Investment Funds