Norway | Current State of Crowdfunding 2022

An Overview on Norwegian Crowdfunding

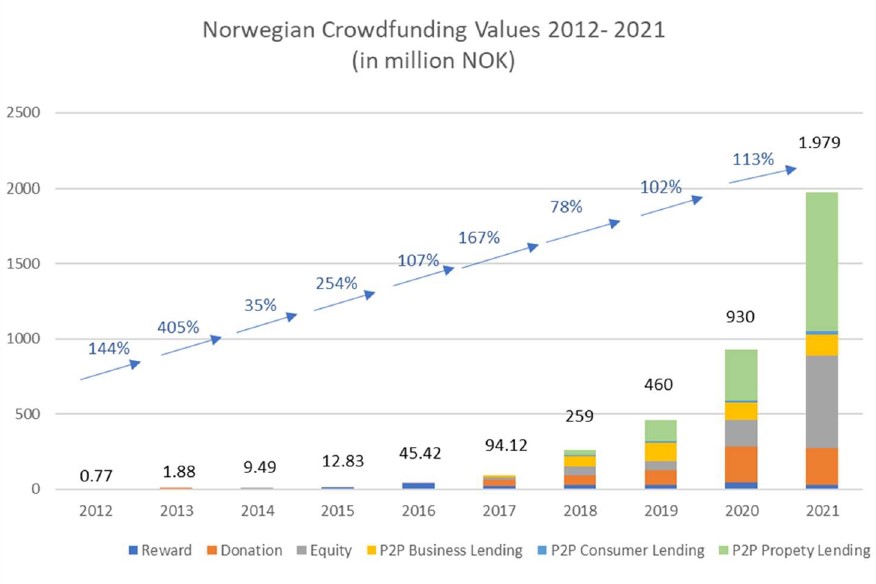

Norway Crowdfunding Values 2012 – 2021: Total collection

During the past 10 years, crowdfunding has experienced an exponential growth in Norway. In 2021, 1.98 Billion Norwegian Krone (equivalent to about 194.4 Million euros – all numbers below in NOK are converted to numbers in euro) was collected through crowdfunding, marking an increase of 113% as compared to the year of 2020, during which only 91.4 Million euros was collected.

About 31.5% of the total collection, therefore 61.2 Million euros was raised in Q4 2021, rendering an increase of 62% in volume as compared to Q4 2020. The extraordinary collection of Q4 2021 also made it the best performing quarter of the year (an increase of 22% comparing to Q3 2021), and the quarter with the largest collection on record.

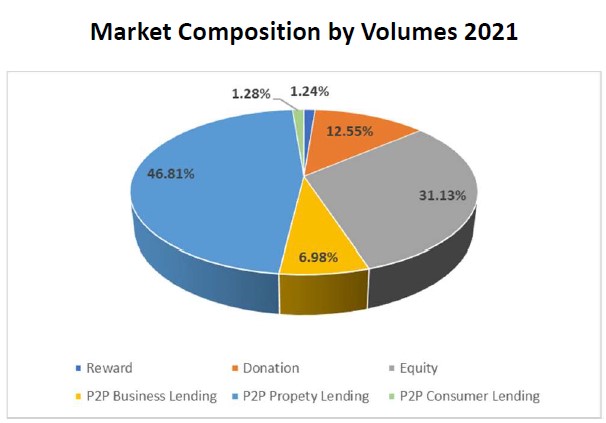

As we can see in the chart Norwegian Crowdfunding Values 2012 – 2021, P2P property lending has been the dominant crowdfunding model since the year 2020, with 46.8% of collection in volume in 2021 (standing for a total raised amount of 91 Million euros), versus 32.2% of collection in 2020 (a total raised amount of 29.4 Million euros).

Another impressive growth came from Equity-based crowdfunding – resulting with an extraordinary increase of 255% as compared to the previous year, equity-based crowdfunding has raised 60.5 Million euros in 2021, whereas this number was merely at 17 Million euros one year ago.

Market Composition by Volume & Key Findings

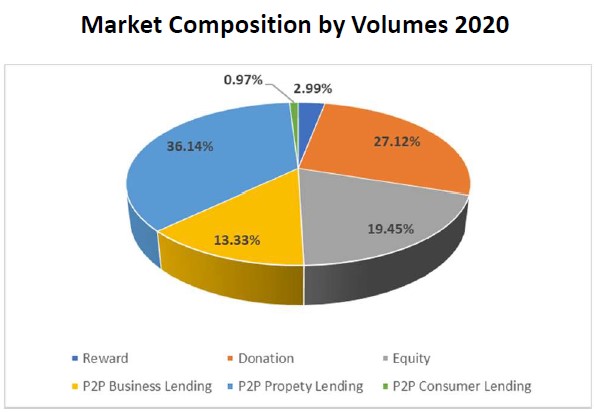

As mentioned above, P2P property lending was the dominant crowdfunding model in 2021, raising almost half of the total collection. In 2020, P2P property lending was already leader of the market, however with less weight, raising 32.2% of the total collection.

The second market driver was equity-based crowdfunding. The market share of equity-based crowdfunding has reached 31.1% as compared to 19.5% in the previous year, reaching a total raised amount of 60.5 Million as compared to 17 Million in 2020.

Disregarding the modest increase in percentage of P2P Consumer lending, we also observed a decline in percentage for donation-based crowdfunding, P2P business lending and reward-based crowdfunding. This decline in percentage does  not necessarily mean a decline in the collected amount, since the total collection has doubled between the year 2020 and 2021.

not necessarily mean a decline in the collected amount, since the total collection has doubled between the year 2020 and 2021.

We also noticed that donation-based crowdfunding recouped ground after recent declines. While Q4 2021 still represent a decline from peak results in Q4 2020, the segment is recouping lost grounds in Q4 2021 and changes momentum towards growth again. Q4 2021 volumes of 7.7 Million euros represent a 31% decline from Q4 2020 volumes (11.2 Million euros), but donation-based crowdfunding also shows an increase of 110% from Q3 2021 volumes (3.7 Million euros).

Reward-based crowdfunding’s recovery renewed after a setback in Q3. Q4 2021 volumes of about 600,000 euros represent a decline of 45% from peak volumes in Q4 2020 (1.1 Million euros). However, Q4 volumes represent a growth of 11% from Q3 2021 volumes (about 520,000 euros).

Conclusion: Comments and Platforms

In the past year, the Norwegian crowdfunding industry has experienced an impressive growth of 113%, and this growth has been steady since the past few years, rendering the industry’s rapid development, which has reached a total collection of 194.4 Million euros in 2021.

In reward and donations most platforms allow a “take what you get” approach to campaigns and not “all or nothing”. Hence, some campaigns were “successfully completed” without reaching full target goal sum.

Since users and traffic data were not available in all platforms separately for donation- and reward-based crowdfunding, these two specific figures were merged to joint figures. All other available figures are presented separately by model.

At the same time, campaign application, users, and traffic data were not available in all platforms separately for P2P Business and Property lending. These specific figures were merged to joint figures. All other available figures are presented separately by model.

Also, an overview on crowdfunding platforms operating in Norway:

Local platforms which provided data:

- Donation & Reward: Bidra, CulturaFlokk, Spleis, Startskudd, and Lokalverdi

- Equity: DealFlow and Folkeinves

- Lending: Monio (former – Monner.no), FundingPartner, Kameo, Oblinor, PERX, and Kredd

Local platforms that did not provide data: Sponsor.me

International platforms (included in 2012-2020 data, and not yet included in data reported from 2021 onwards):

- Reward: Kickstarter, Indiegogo

- Donation: Facebook, GlobalGiving, LaunchGood

- Equity: Invesdor, Seeders

- P2P Business Lending: Trine

- Balance Sheet Business Lending: Paypal

Local platforms/models not yet operational:

- Lending: Green Currency, Lendonomy

- Equity: Monner

- Real Estate Crowdfunding: PropShare