Alternative Finance Maturity Index

Description of Research Areas

- Degree of organization/access to data

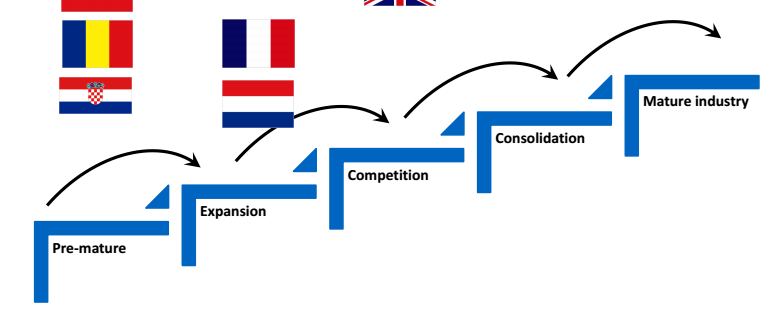

In the majority of countries there is no data available about total volumes of the industry, mostly because there is a low level of organization of the industry. In the United Kingdom, the Netherlands and France data about the total volume of the industry are collected, structured, aggregated and reported on a yearly basis. In some countries, e.g. Germany, there is only aggregated data available about volumes in subsectors of the industry. It is important to note that there is increasing disagreement about precise volumes in countries, also because reporting is often done by sources closely linked to the industry.

- Volumes

Because of the lack of aggregated data in the majority of countries it is difficult to have an exact ranking of countries based on volumes. Many countries reported that volumes are growing fast, in some cases more than doubling each year. In the European Alternative Finance Benchmarking report (based on volumes in 2014) the UK ranked first, France ranked second at a great distance. In 2015, UK and France are in terms of volume still the indisputable numbers one and two. Germany, Sweden and the Netherlands ranked 3rd, 4th and 5th. We have no reason to believe that in 2015, these countries don’t rank in the top 5 anymore but because of the lack of data (Germany, Sweden) we can’t give a precise ranking. In terms of volume per capita Germany and France rank lower than Sweden and the Netherlands and Estonia has on average a high volume per capita, although most come from P2Pconsumer lending.

- Diversity in types of platform

Generally speaking, all types of platforms are present in most countries. Exceptions arise in the cases were a type of crowdfunding is prohibited by law (e.g. in Belgium P2P lending is not allowed). Equity based crowdfunding is on the rise in almost every country. In Portugal there is little diversity despite the fact that there are no major regulatory burdens. In Lithuania equity and lending based platforms can only operate with a credit institution licence.

- Level of activity

As can be in expected in an evolving market, there is a high level of activity in most countries. Many new platforms have entered the market. There is a clear correlation between the level of activity and new regulation that came or will come into effect. E.g. in Lithuania, with less than 3 million inhabitants, five P2P consumer-lending platforms have been launched in the last year, anticipating new regulations.

- Cross border activities

Many platforms that are successful have presence in neighbouring countries as well. If there are no language barriers, the level of cross border activities increases. WeMakeIt and Conda, headquartered in respectively Switzerland and Austria, are good examples of platforms that have expanded successfully to neighbouring German speaking countries. Bondora is an Estonian based platform that has a presence in neighbouring and in many other European countries as well.

- Approach of the Banking Industry

The banking industry has had a wait-and-see approach and is now slowly entering the industry either with platforms owned by themselves or through partnerships. In Portugal Novo Banco Crowdfunding is launched, a donation based platform, in which Novo Banco accounts for 10 per cent of the total funding. The types of partnerships can be very different. There are examples of existing platforms that are integrated (white labelled) in a banking platform as is the case with Ulule and BNP Paribas in Belgium.

- Approach of the Government

National governments take different stances towards crowdfunding. The UK government is the most progressive with the introduction of requirements for banks to be obliged to offer alternative finance options to clients to whom they refuse loans. In Belgium the government has taken an active role in launching, operating and financing crowdfunding platforms. Regulatory framework

- Donations based crowdfunding

Donation based crowdfunding is possible in every country under existing regulations, in some countries some additional conditions have to be met, e.g. in Finland a very strict Act on Fundraising applies, causing extra administrative burden.

- Reward based crowdfunding

Reward based crowdfunding is possible in every country under existing regulations. In some countries reward based crowdfunding is considered as e-commerce/online shopping with the obligations to refund purchases. The VAT regime that applies to reward based crowdfunding is subject to discussion in many countries.

- P2P business/consumer lending

Compared to the other types of crowdfunding, regulations regarding P2P lending differ a lot between countries. P2P lending is prohibited in Belgium. In France an entrepreneur cannot lend to another entrepreneur. In Italy lenders cannot directly choose borrowers. In some countries P2P consumer lending is fully unregulated, but legislation is prepared to protect consumer interests and prevent irresponsible borrowing.

- Equity Based Crowdfunding

In most countries equity based crowdfunding is possible under existing regulations for securities intermediation, but very strict regulations apply. In Denmark equity based crowdfunding is not possible for Danish based businesses. The way around it is to open a pro forma address in the country of origin of a foreign crowdfunding platform. As a result, UK equity platforms have started operations in Denmark.

- Special Regulations to Foster Access to Finance for SME’s

Many countries implement special regulations to foster debt and equity based finance to promote entrepreneurship. For example, Austria’s new legislation is considered to be at the forefront of legislation in Europe. With the new law the obligation to publish a complete prospectus will only be needed for raising over €5 million. Many other countries have implemented or are planning to implement similar legislation with different maximum amounts. Belgium seems to be lagging behind.

- Special Regulations to Protect Consumer Interests

Whereas in the field of equity crowdfunding regulatory bodies are implementing new, more liberal regimes, the opposite takes place with regard to P2P consumer lending. In some countries, like Estonia, P2P consumer lending was until recently unregulated causing serious social problems with regard to so-called SMS loans because of irresponsible borrowing.

- Registration Obligations

France and the Netherland are examples of countries were recently the obligation for lending and equity based crowdfunding platforms to register is implemented. In both countries more than 60 platforms are registered.

- Tax reliefs

Tax reliefs are applied in a few countries. UK is leading the way with Seed Enterprise Investment Schemes and Enterprise Investment Schemes Measures. Belgian has worked on similar tax shelters.